National News

Local News can be found here

Help with Community Governance Degree Dissertation

We have received a request from the Town Clerk to Knutsford Town Council, who is seeking help from parish councillors and clerks with his Community Governance Degree.

Good Evening,

I am completing the final year of my Community Governance Degree with De Montfort University/SLCC, which involves a research dissertation.

My research is looking at the impact of unitary council creation on parish and town councils. I am looking to measure the impact on local councils since unitary councils have been created contrasted with the changes to local councils since 2011 (the year of the Localism Act and the time of austerity).

I would be grateful if you could share this email with your member councils asking them to complete my research survey: https://www.knutsfordtowncouncil.gov.uk/the-impact-of-unitary-council-creation-on-parish-and-town-councils-in-england

I am seeking both clerks and councillors to complete the survey (with some slightly different questions for each). To measure the impact of unitary council creation, I need as responses from councils who are under the two-tier principal authority system as much as I do those under unitary councils.

Many thanks,

|

Adam Keppel-Green BSc FSLCC MCMI

|

Star Council Awards 2023 - nominate now!

OALC supports the National Association of Local Councils (NALC) Star Council Awards which celebrate the hard work and dedication of the parish and town council sector.

We really hope that all Oxfordshire councils will think long and hard about this opportunity. We have had runners up in several categories over the years, perhaps this year there will be a winner.

Is there a councillor that has gone above and beyond, have they got a much needed project off the ground and through to completion? Your Clerk is a hard working star and has shown exceptional professionalism? This is the opportunity to shine a national spotlight on outstanding work and individuals. Don’t be modest, all too often councillors get brickbats, this is a rare opportunity to identify and praise the good positive work done at community level.

The Star Council Awards are the only awards programme in England specifically designed to recognise the contribution of local councils to their communities. The awards are open to all local councils, councillors, young councillors, clerks, and county associations across England.

There are five award categories for which entrants can apply:

- Clerk of the Year,

- County Association of the Year,

- Young Councillor of the Year,

- Councillor of the Year, and

- Council of the Year.

The nomination period ends on 28 July 2023, and the winners will be announced and given their awards at a ceremony in the House of Lords on 29 November 2023.

Visit www.nalc.gov.uk/starcouncilawards for more information on the Star Council Awards 2023 and how to submit.

Summer heat wave?

As we head into the summer, people start dreaming of sunny blue skies and planning summer outings and holidays. However, as we saw last year, high temperatures need planning for just as much as winter and snow does. The Met Office is running a summer WeatherReady campaign to spread the word about the range of simple actions people can take to minimise the impact of severe weather on them and the knock-on effect on emergency response teams.

The campaign brings together and shares expert partner advice designed to help people understand how to best respond to the weather so they stay safe and make the most of the different seasons.

10 things you should do now to prepare for summer - Met Office

Community Ownership Fund opened to parish councils

The government's Community Ownership Fund has been extended to allow applications from parish and town councils for the first time.

The Community Ownership Fund is a government programme with £150m over four years run by the Department for Levelling Up, Housing and Communities to help communities take ownership of assets at risk of closure across the UK.

The National Association of Local Councils (NALC) has been lobbying the government to extend the fund's eligibility to local councils. Only community and voluntary organisations have been allowed to apply, with all types of councils excluded. In addition to allowing applications from local councils, other changes to the fund include increasing the amount of funding all projects can bid for from £250,000 to £1m and the requirement for match-funding reduced to as low as 10%.

Round three of the fund launched on 11 May and aims to support community ownership projects such as sports facilities, arts and music venues, museums and galleries, parks, pubs, post offices and shops.

Find out more about the Community Ownership Fund here https://www.gov.uk/government/collections/new-levelling-up-and-community-investments#the-community-ownership-fund-round-3

Read the government's full statement here https://www.gov.uk/government/news/more-cash-to-rescue-community-assets-through-expanded-government-fund

Revised edition of NALC Being a good employer May 2023

Being a good employer is essential to being a councillor, and the newly updated guide offers a comprehensive and straightforward approach to key employment areas.

The guide has six sections that cover the complete job arc from recruitment to leaving an organisation for any reason. The information contained in each section is based on employment legislation and good practice. The guide is essential to help all councillors be good employers and make their employees feel more valued and effective.

The guide encourages readers to explore the resources and support of the Civility and Respect Project. A joint project between NALC, county associations, the Society of Local Council and One Voice Wales. The project aimed to prioritise civility and respect in the local council sector and change culture.

We have placed an ecopy in the Members Area of our website. Printed copies are available but cost £7.50 + and are only printed by NALC on demand.

The Future of Local Councils - SLCC and De Montfort report January 2023

This report is the result of collaboration between SLCC and the Local Government Research Centre at De Montfort University

Published January 2023

The survey was carried out by SLCC of its members, thus the responses reflect the views of those Clerks who are members of SLCC. The data was collected from an online survey of 591 town/parish council clerks between 23rd September 2021 and 22nd October 2021. The sample represented approx. 7% of all local council clerks, which is not statistically representative but nevertheless has some useful insights on how councils and clerking have changed over the last thirty years. For example -

The Council and Councillors

- The membership of councils ranged from 5 to 31 councillors.

- The average size of a local council was 12 councillors but the most common size was 7 councillors

|

5-9 councillors |

38% |

|

10-14 councillors |

35% |

|

15-19 councillors |

23% |

|

20+ councillors |

<5% |

- Increase in councils controlled by national political parties – 1991 10%, 2021 23%

- In 2021 women councillors remain under-represented, male councillors outnumber female counterparts in 76% of local councils

- The overall level of co-options remains high, 74% of councils co-opted members in 2021 an increase on 1991 when it was 56%

- 45% of councils had dual hatted councillors an increase on the 1991 figure when it was 34%

- 15% of councils had triple hatted councillors

- Length of service of Chair

|

I year |

36% |

|

1-3 years |

33% |

|

3-10 years |

25% |

|

10+ years |

7% |

The report is here https://www.slcc.co.uk/site/wp-content/uploads/2023/01/SLCC-Future-Report-2022.pdf

Sec 137 amount for 2023-24

The letter from Ben Greener, Deputy Director, Communities & Integration Directorate, Department of Levelling Up, Homes and Communities to Jonathan Owen, CEO of NALC, dated 6th February states:

This is to notify you that the appropriate sum for the purpose of section 137(4)(a) of the Local Government Act 1972 (the 1972 Act) for parish and town councils in England for 2023-24 is £9.93.

This is the amount as a result from increasing the amount of £8.82 for 2022-2023 by the percentage increase in the retail index between September 2021 and September 2022, in accordance with Schedule 12B to the 1972 Act.

Voter ID now required for elections

For the first time, voters will need to show photo ID to vote at local elections in England on 4 May, following new requirements introduced by the UK Government’s Elections Act 2022.

More information here https://www.electoralcommission.org.uk/i-am-a/voter/voter-id

For all voters, including older people and disabled voters, the voting process in May will be very similar to how they voted before, with the added requirement to present photo ID. A staff member will ask voters for their name and check they are on the electoral register and then ask to see their ID and check it looks like them. They will then cross the voter’s name off the register and hand them a ballot paper. Polling station staff will be on hand to support them with any questions and assist them in showing their ID. We’re encouraging people to check now if they have one of the accepted forms of ID, and to apply for the free voter ID, or indeed to choose one of the other voting options available if they do not want to show ID.

Voter ID

- Accepted forms of ID include some concessionary travel passes, such as an Older Person’s Bus Pass or an Oyster 60+ card. Other accepted forms of ID are:

- A passport issued by the UK, any of the Channel Islands, the Isle of Man, a British Overseas Territory, an EEA state, or a Commonwealth country

- A driving licence issued by the UK, Northern Ireland, the Channel Islands, the Isle of Man, or an EEA state

- People will be able to use expired photo ID if they are still recognisable from the photo..

Applying for the Voter Authority Certificate

- A new form of free ID, the Voter Authority Certificate, will be available for those who do not have another type of accepted ID.

- Voters can apply for free voter ID by completing and posting a paper form to their local council’s electoral services team. Some local authorities may accept applications in person. Voters will need to provide a photograph, their date of birth and National Insurance number as part of the application.

- Voters can also apply for free voter ID online at voter-authority-certificate.service.gov.uk/

- Anyone who needs voter ID to vote in the May 2023 elections, must apply by 5pm on Tuesday 25 April.

Absent voting

- If a voter would prefer not to show ID at a polling station, they can apply to vote by post or proxy. Photo ID isn’t required to apply or vote by post or proxy. Though, their proxy will be required to show their photo ID at the polling station.

- For the May 2023 elections, the deadline for applying for a postal vote is 18 April 2023, and the deadline for proxy is 25 April 2023.

- Voters can apply to vote by post by filling out a form and sending it to their local council. People can also contact their council to ask for the form to be posted to them, if they are unable to print it. The process is similar for a proxy vote, and voters will need to fill out a form explaining why they can’t get to their polling station.

For voters who are not comfortable with using technology to find out additional information about voter ID, different ways of voting, or how to obtain the free voter ID they can call the Electoral Commission’s helpline on 0800 328 0280, or their local council.

Protecting parks and green spaces with Fields in Trust

Parks and green spaces are places of joy and togetherness valued by the entire community from pre-school children to retired adults. We all have fond memories of our favourite places to play, enjoy sport and experience the natural world. Parks provide places for exhilarating fun or a moment of quiet reflection. Yet we know that these much-loved green spaces are vulnerable to development if they are not protected. Once a park is gone, it is gone forever.

Parks and green spaces have a key role to play in:

- Mitigating climate change

- Connecting communities

- Benefiting health and wellbeing

- Providing accessible recreational space

- Pandemic recovery

To continue to fulfil this role, they need to be protected.

Fields in Trust champions and supports parks and green spaces by protecting them for people to enjoy in perpetuity. Our Deed of Dedication ensures that protected land remains owned and managed by the landowner and provides flexible yet robust protection against non-recreational development.

More information here - www.fieldsintrust.org/what-is-protection

New Internal Audit Forum

OALC encourages all councils to use professional Internal Auditors, preferably those who are members of the IAF.

More information here - Internal Audit Forum

Assets of Community Value database

Keep It in the Community (KIITC) is an online database of all community assets in England, such as pubs, shops and land, that have been nominated or registered as an Asset of Community Value (ACV).

Keep It in the Community is hosted by the Plunkett Foundation – one of the organisations involved in its original conception. The information on KIITC is supplied by members of the public and checked by Plunkett against council records.

The top 3 types of asset registered on the Keep It in the Community register are:

- Village halls

- Green spaces

- Pubs

Other types of asset include shops, cafes, post offices, sports clubs, allotments, religious buildings and libraries. There is data relating to 6,700 assets on Keep It in the Community register, of which 3,700 have an active ACV registration.

For more information and guidance on how to register a local asset go to your own district councils website.

Sec 137 amount for financial year 2022-23

The appropriate sum for the purpose of section 137(4)(a) of the Local Government Act 1972 for parish and town councils in England for 2022-23 is £8.82.

This is the amount as a result from increasing the amount of £8.41 for 2021-2022 by the percentage increase in the retail index between September 2020 and September 2021, in accordance with Schedule 12B to the 1072 Act.

7th February 2022

NALC publication on website accessibility

The National Association of Local Councils (NALC) has a guide on website accessibility and publishing guidelines.

The guide aims to help local (parish and town) councils ensure their websites meet the needs of all users — especially those with disabilities or impairments that use assistive technology.

The guide explains what website accessibility is, how it affects local councils, the requirements, and compliance. It details what a council must publish under the Transparency Code 2015, the costs of running a website, where to get help, what ongoing checks are needed, and discusses the future of website accessibility. The guide also contains a step-by-step guide and a range of resources.

The guide can also aid those who write and create content for websites and use it as guidance to give to their website designers who may not be aware that local government websites need to comply with the Transparency Code.

NALC Climate Change case studies July 2021

CLIMATE CHANGE CASE STUDIES

The Climate Change case studies publication is for local councils and county associations to use as an example of work that can be carried out in their communities. These are all examples of best practise and demonstrate actions to tackle climate change locally.

The publication is divided into various topics; biodiversity, carbon off-setting and reduction, climate change forums, community projects, designing greener housing, electric charging points, energy and heating, environmental improvement, flood assistance, green travel, plastic reduction and trees and tree management. It is designed to incorporate all areas of climate change.

Read the Climate change case studies publication here on the NALC website https://www.nalc.gov.uk/library/our-work/climate-change/3297-climate-change-case-studies/file

RHA Parish Councillor's guide to Affordable Housing

English Rural published a guide (PARISH COUNCILLORS’ GUIDE TO RURAL AFFORDABLE HOUSING) aimed at local (parish and town) councillors on affordable rural housing.

Rural communities can only thrive if good quality affordable homes are available to those who live and work in rural areas. Yet, in many rural communities, affordable housing is lacking, or in some cases, absent. This is not a new problem, but one that has grown worse. Across the country, local councils have supported and been a critical partner in delivering small scale affordable rural housing developments. These have provided high-quality homes that are affordable to run.

The guide is an interactive document packed with information, case studies and short videos. Additionally, it takes you through the different options available, the stages in the development process, who the key players are, and insights on the technical matters that help make decisions. The guide will help you deliver new homes that you can be proud of, and help your community thrive.

English Rural is a specialist provider of community-led, affordable rural homes established in 1991. They are one of the leading national advocates on affordable rural housing issues.

Read the PARISH COUNCILLORS’ GUIDE TO RURAL AFFORDABLE HOUSING here parish-councillors-guide-to-rural-affordable-housing.pdf (ruralhousingalliance.net)

NALC The Good Councillor's guide to cyber security

NALC published The Good Councillor's guide to cyber security in partnership with Microshade VSM.

The guide aims to help local (parish and town) councils understand the importance of cyber security better and provide practical advice on minimising risks to the council. The guide features information on understanding the most common threats such as phishing, viruses, loss of data and how some simple steps can help protect the council's data and equipment.

The guide pays particular attention to smaller councils, which may have just one device that holds all current and historical information on the council's activities. If that device is lost or broken, a few simple, pre-emptive steps to minimise risks and back up data could transform a crisis into a manageable situation.

The COVID-19 pandemic has seen an unprecedented transformation of local councils as they have moved to remote meetings and home working. These changes have allowed local councils to continue supporting communities through these challenging times. However, with these benefits, there are many challenges. One of these is cyber security, and the local council sector must understand it to safeguard the council's good work for its communities.

You don't need to be a technical expert to safeguard your council. With this guide, along with a small investment of time and resource, your council can reduce these risks.

The guide is in the Member’s Area of the OALC website.

The Good Councillor's Guide to Community Business December 2020

NALC and the Plunkett Foundation have launched The Good Councillor's Guide to Community Business to promote the opportunities that community businesses can create locally.

You can find a copy to download in the members area of the OALC website https://www.oalc.org.uk/members-area under NALC briefings

The Plunkett Foundation (based in Woodstock) wrote the guide in partnership with Power to Change (the independent trust that supports community businesses in England).

The guide is a comprehensive resource that will enable local councils to understand better how a community business could enhance their parish or town in a post-Covid society.

Community businesses are enterprises that are owned and run democratically by members of the community and others, on behalf of the community. They come in many forms, including shops, pubs, woodlands and anything which lends itself to community ownership.

In addition to developing and safeguarding valuable assets and services, community businesses address a range of issues including isolation, loneliness, wellbeing, work and training. As well as bringing people together and attracting people to a local area, for every £1 spent in a business, a further 56 pence is spent locally as the money dissipates.

Throughout the coronavirus pandemic, the importance of local services has never been more apparent. However, the reality is that an increasing number of services are at risk of closure due to market forces, lack of funding, or due to the effects of the pandemic. This means that many residents, many of whom are dependent or vulnerable, are losing access to essential amenities. In these areas where there is a concern of services being lost, the community business approach is often a viable and sustainable solution.

This guide intends to provide the practical "how-to" knowledge behind a community business and inspire a new generation of businesses to open. Also, there is support available from Plunkett Foundation, Power to Change and the National Association of Local Councils to ensure that councillors can access further expertise and resource to realise the ambition of setting up a community business in their area.

Chris Cowcher, Head of Community Business at Plunkett, said: "We are delighted to be supporting this project because local councils have the power to encourage, facilitate and support more community businesses to open. The guide launched in a year when community businesses have stepped up more than ever to serve their residents across the UK in the most challenging of times. These enterprising businesses, time and again show themselves to be inspirational and inclusive operations, and it is exciting to think that this guide will lead to even more setting up.It is often vital that local councils are engaged, contribute to and collaborate with community business projects and through working with NALC and Power to Change we hope that we can create an environment where these businesses can flourish."

NALC Chairman, Cllr Sue Baxter, said: "I'm delighted for the launch of The Good Councillor's guide to community business. Local councils play a significant role as service deliverers for their communities, through supporting local economy and business. It is encouraging that the sector already engages with community businesses and hope this latest publication will empower councillors with information to support community businesses and extend their take-up across the country".

Ailbhe McNabola, at Power to Change said: In 2020, community businesses have really come into their own. They have demonstrated just how agile and adaptable they can be, stepping up during the pandemic to provide vital support and services for the most vulnerable in their communities. Every town or village should have at least one community business. Run by local people for the benefit of local people, they have resilience hardwired into their business model; and with 56p of every pound spent by a community business staying in the local economy, it makes financial sense too.”

For more information on the guide and the support available through Plunkett to help local councils support the opening of more community businesses visit: www.plunkett.co.uk

Governance and Accountability for Smaller Authorities or The Practitioners Guide

The Practitioners’ Guide is issued by the Joint Panel on Accountability and Governance (JPAG) to support the preparation by smaller authorities in England of statutory annual accounting and governance statements found in the Annual Governance and Accountability Return (AGAR).

The Guide is reviewed and published every year at the beginning of the financial year. The latest edition is in the Members Area of our website or via NALC - https://www.nalc.gov.uk/jpag

20 actions town and parish councils can take on the climate emergency

This guide complements Friends of the Earth’s template Local Climate Action Plan1 .

The guide identifies actions that parish and town councils can take on climate

change and nature. Its purpose is to support those of the 10,000 local councils across

England and 750 community councils in Wales who want to “do their bit” in addressing

the climate and nature emergency.

The actions are grouped under three headings:

1. Be a force for good

2. Demonstrate leadership through your own practical actions

3. Use your powers wisely

Updated NALC Model Financial Regulations July 2019 and guidance

The NALC Model Financial Regulations have been updated. The previous version was issued in January 2016, these are replaced by the July 2019 version which is now available in the Members Area of our website together with guidance on their use. NALC recommends you read the guidance before and during adaptation of the Regulations to the particular circumstances of your council.

Please ensure you review and revise your Financial Regulations on a regular basis and ensure they are up to date and fit for purpose.

Setting up a community run post office

Just under 200 community-run shops and pubs also provide post office services, often in rural areas where people can face significant barriers to accessing essential services.

Citizen’s Advice Bureau research (2019) into community-run post offices showed the significant benefits they deliver to local communities. However, setting one up can be difficult.

Since then Citizen’s Advice Bureau have worked with the Plunkett Foundation and Post Office Limited to produce this guide [ 280 kb] to make it easier for community-run enterprises to apply to run a post office.

Further advice and support for community-run groups and businesses can be accessed through the Plunkett Foundation here.

Get your parish council to sign the Tree Charter

In November 2017, it was the 800th anniversary of the influential 1217 Charter of the Forest and the Woodland Trust launched the Charter for Trees, Woods and People. They believe the people of the UK have a right to the benefits brought by trees and woods. The Charter recognises, celebrates and protects this right.

There are 10 principles associated with the Charter:

- Plant for the Future

- Sustain landscapes rich in wildlife

- Celebrate the power of trees to inspire

- Protect irreplaceable trees and woods

- Plan greener local landscapes

- Recover health, hope and wellbeing with the help of trees

- Make trees accessible to all

- Combat the threats to our habitats

- Strengthen our landscapes with trees

- Grow forests of opportunity and innovation

The Woodland Trust would like parish councils to sign the Charter and show their commitment to these principles.

More information on the Woodland Trust website here - https://www.woodlandtrust.org.uk/support-us/act/tree-charter/

NALC GDPR Toolkit (revised) August 2018

The original GDPR toolkit was sent to all member councils in 2018. It has been revised to to reflect changes since then concerning:

- town and parish councils no longer required to have a Data protection Officer

- the need to register with the ICO

the revised edition is in the Members Area of this website.

For more information on GDPR look on the Information Commissioners Office (ICO) website -

https://ico.org.uk/media/2615577/parish-councils-data-audit-exercise.pdf

The Good Councillors Guide to Neighbourhood Planning

National Association of Local Councils (NALC) in association with Locality published in 2017 The good councillor's guide to neighbourhood planning.

The guide is aimed at local councillors who are interested in finding out more about their role in relation to neighbourhood planning or perhaps belong to a council who are embarking on producing a neighbourhood plan for their area.

Neighbourhood planning was introduced by the Localism Act 2011. Communities can shape development in their areas through the production of neighbourhood development plans and other initiatives detailed in this guide.

Cllr Sue Baxter, chairman of NALC, said: “Given these rights have a huge bearing on how a council engages with its community to undertake the process it is vital that local councillors understand the key principles of neighbourhood planning in order to support their communities appropriately.

“For these reasons Locality and NALC have worked together to produce this guide in order local councillors are equipped with the basic information to get them started. However it does not stop here and there will be a need for councillors to find out more as the process unfolds.”

Local councils can access print copies of the The Good Councillor's guide to neighbourhood planning by contacting their local county association

The guide is available to download from our Members Area.

Election of Chair and Annual Parish Council Meetings

By the end of May every parish council should have held their Annual Parish Council Meeting, and the Chair of the parish council should have called the Annual Parish Meeting (which must be held by 1st June each year).

We know that there is still confusion in some quarters about the requirements in relation to these two meetings which have similar names.

To summarise:.

- The Annual Parish Council Meeting must by law be held in May. This is a statutory requirement.

- The first business of the Annual Parish Council Meeting must be the election of the Chairman. This is a statutory requirement. If no Chairman can be elected the meeting cannot continue beyond this agenda item.

- There is no statutory requirement for a Councillor to be present at the Annual Parish Council Meeting in order to be elected as Chairman.

- The Clerk should not be in the chair during the election of Chairman, this is a common misunderstanding. A Clerk can never take the chair of a council meeting.

- The current Chairman must by law use their casting vote in the case of a tie in the election of Chairman (see NALC Legal Topic Note 2 for full details).

- The newly elected Chairman must sign a declaration of acceptance of office form before taking the Chair, which they should do immediately following their election.

- There is no statutory process or requirement for nominations, etc. Your council's Standing Orders may provide for this, but if they do not then any councillor can stand for election as Chairman at the Annual Parish Council Meeting without notice or nomination by another.

- The Annual Parish Meeting is not a Council meeting, but rather is a meeting of local government electors registered for the area for which it is held. It must be held between 1st March and 1st June. It is entirely separate from the Annual Parish Council Meeting, though is sometimes held on the same evening.

- The minutes of the Annual Parish Council Meeting must be approved at the next Parish Council Meeting, and must not be held over until the following year's Annual Parish Council Meeting.

The Good Councillors Guide

The Good Councillors Guide is available. It can be downloaded for free from the Members Area of the NALC website (the username and password are in the Members Area of our website) or printed copies are available from OALC - £4 per copy + £1.20 p&p per copy

Community Asset Transfers

This guide, produced by Locality in partnership with the Local Government Association and the National Association for Local Councils, highlights the strategic importance of Community Asset Transfer (CAT) for councils and communities in England.

Community asset ownership isn’t new – there is a long and rich history going back centuries of communities owning and managing land and buildings. More recently, CAT is the recognised mechanism to enable the community ownership and management of publicly owned land and buildings, to enhance social, economic or environmental wellbeing in local areas.

The positive opportunities as a result of CAT have been given fresh impetus by the devolution agenda. However, there continues to be a need to inform and encourage councils to work with local people, Parish and Town Councils and other stakeholders to ensure that the role that CAT can play in building resilient communities and thriving neighbourhoods is maximised.

In order to help councils to be clear about the set up and ongoing resources required to get the process right, this guide reiterates the critical success factors that underpin CAT. There also advice on the risks and mitigating actions that should be considered, and a step-by-step approach to developing a fit for purpose CAT policy to help inform council decision making.

Therefore, whether your council is new to CAT and you are seeking to make the case for its strategic adoption or you are looking to scale up, this guide aims to help officers and members better understand how CAT can help support your council's priorities.

Planning Aid England

Planning Aid England is funded by the Royal Town Planning Institute, a registered charity. It is separate from both central and local government and provides completely independent and impartial planning advice.

Their website https://planningaid.zendesk.com/hc/en-us/articles/202851051-How-to-use-this-website- provides:

- Answers to questions people often ask about planning

- Clear, simple explanations of how the planning system works

- Signposting on where to go next

If, after having looked at their website advice, you still need help, you can access the PAE online advice service via https://planningaid.zendesk.com/hc/en-us/requests/new

This service offers a limited amount of free, general planning advice by email. It is delivered by a panel of volunteer planning advisors, all of whom are Chartered Planners.

Planning Aid's planning advisors are happy to answer enquiries on planning-related issues in England and aim to respond to enquiries within 5 working days (though this cannot be guaranteed during exceptionally busy times).

In some situations, depending on your circumstances and the availability of PAE volunteers, they may be able to offer further support.

Resources to make things happen and improve your community

Just Act helps anyone involved with a community project to find information. The 10 Steps go through the key stages of running a project and the Knowledge Bank has information for different types of projects. - See more at: http://www.justact.org.uk/#sthash.UNOvk3ma.dpuf

There is a good case study arising from a study of 120 community buildings in Oxfordshire called Managing energy use in community buildings, more information here http://www.justact.org.uk/wp-content/uploads/2012/05/ENRICH-Guide-FINAL.pdf

Neighbourhood Plan support from Locality and Community First Oxfordshire

The Department for Levelling Up, Housing and Communities (DLUHC formerly MHCLG) is providing over £45 million of support to groups developing neighbourhood plans and neighbourhood development orders between 2018-2023. The government has said it is highly likely that it will extend the funding after March 2023.

There are two main types of support that groups can apply for:

1. Grant funding

2. Technical support

Locality is managing the support and application process on behalf of DLUHC.

You can find guidance on the regulations and legislation of the neighbourhood planning system on Gov.uk

Don't forget you can seek more local advice from Community First Oxfordshire as well. They provide a Neighbourhood Plan consultancy services, more details here https://www.communityfirstoxon.org/housing-planning-placemaking/neighbourhood-planning/

Financial Services Compensation Scheme (FSCS) to cover deposits of small local authorities

From 3rd July 2015 the UK Financial Services Compensation Scheme (FSCS) will cover the deposits of small local authorities. The definition of small local authority being one that has an annual budget of less than €500,000 (currently £355,700 as it is based on the exchange rate on 3rd July each year). This will extend cover to over 8,000 parish and community councils.

The UK FSCS will cover the first £75,000 of eligible deposits, a reduction from the previous figure of £85,000. The previous limit will remain in force for individuals and small companies until 31st December 2015, but the new rate will apply immediately for councils.

The FSCS ensure that eligible bank depositors have access to their eligible deposits within fifteen business days of receipt of a request from the depositor which contains sufficient information to enable the FSCS to make a payment. The formal announcement of the change can be found on the Bank of England’s website.

NALC Financial briefing note F05-15 is in the Members Area of the OALC website

Local Council Award Scheme

The Local Council Award Scheme is designed to provide the tools and encouragement to help parish and town councils improve, as well as promoting and recognising those councils that are already well run and are examples of good practice.

Councils can apply for an award at one of three levels:

- The Foundation Award demonstrates that a council meets the minimum requirements for acting lawfully and according to standard practice.

- The Quality Award demonstrates that a council achieves good practice in governance, community engagement and council improvement.

- The Quality Gold Award demonstrates that a council is at the forefront of best practice and achieves excellence in governance, community leadership and council development.

The scheme sets out the criteria required to attain each level of the award. It is hoped that councils will want to progress through the levels where resources allow. To achieve any level of award Councils must publish the required documents and information online and pass a resolution at full council confirming their availability.

For more information on the Local Award Scheme, the criteria and a step by step guide to the process for applying go to the NALC website https://www.nalc.gov.uk/our-work/improvement-and-development/local-council-award-scheme

There are two fees; a registration fee paid to NALC, this is £50 irrespective of the size of the council or the level of award. And an accreditation fee which varies from £50 - £200 depending on the size of the council and the level of award.

The accreditation lasts for four years.

Introduction to Local Council Administration (ILCA)

The online Introduction to Local Council Administration (ILCA) is the level 2 sector specific qualification. The learning tool has five sections which can be studied in your own time. Each of the five modules contains activities, questions and explanations. You can gain a certificate and CPD points on successful completion. The modules are:

- Core roles

- Law and procedures

- Finance

- Management

- Community

To register and find more information go to the SLCC website The cost is £120 +VAT for SLCC members.

Local Councils Explained 2013 SOLD OUT

Local Councils EXPLAINED is NALC’s book for local councils in England and Wales. But unfortunately it has been out of print for some time. Second hand copies are available on the internet

Vexatious requests for information, guidance from Information Commissioner

Guidance was issued by the Information Commissioner's Office (ICO) in May 2013. Under Section 14 (1) Freedom of Information Act 2000, public authorities do not have to comply with vexatious requests. It is the request which is vexatious, not the individual making it!

In cases where the issue is not clear-cut, the key question to ask is whether the request is likely to cause a disproportionate or unjustified level of disruption, irritation or distress.

Vexatious = “manifestly unjustified, inappropriate or improper use of a formal procedure”

See the complete guidance on the ICO website

The General Power of Competence - empowering councils to make a difference

The General Power of Competence was introduced in the Localism Act 2011 and came into effect in February 2012. The power is radical in that it allows a council to act as an individual would. (See OALC briefing note in the members Area of this website under OALC briefings and presentations). Town and parish councils can only use the Power if they satisfy the eligibility criteria which are:

- two thirds of councillors have stood for election (they may have stood unopposed)

- the clerk is qualified - Cilca or higher recognised qualifications

- the council resolves to grant itself the Power.

The number of councils in Oxfordshire with GPC is limited. There is no official record kept but we estimate approx 10% of 249 councils may have GPC.

The Local Government Association published research in 2013 on the use that GPC had been put to. It is available here

Guidance on Code of Conduct and Register of Interests

The Department for Communities and Local Government (now DLUHC) issued revised and updated guidance in September 2013 for councillors on the Code of Conduct. It is called Openness and transparency on personal interests, a guide for councillors.

The guidance can be found here

However, since that guidance was issued a new Code of Conduct has been agreed. The Local Government Association (LGA) issued a revised Code in June 2020 -

and associated guidance https://www.local.gov.uk/publications/guidance-local-government-association-model-councillor-code-conduct

In Oxfordshire the Monitoring Officers agreed on an adapted version of the LGA Code and adopted it across all tiers of local government - county, district and parish.

Your own district council has the Code on its website, with more information, guidance and advice about how to make a Code of Conduct complaint. For example here is the link to South Oxfordshire District Council website -

The Code has at its heart the Nolan Principles of Conduct in public life -

- selflessness

- integrity

- objectivity

- accountability

- openness

- honesty

- leadership

Plunkett Foundation - Community Shops and Pubs

The Plunkett Foundation (based in Woodstock) offer assistance to people involved in setting up and running community-owned village shops and pubs. The Plunkett Foundation, a membership organisation, offers funding and practical guidance on setting up community-owned or co-operative local services.

Go to their website for more information https://plunkett.co.uk/how-we-help/

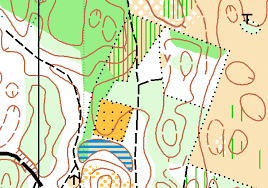

The Public Sector Mapping Agreement

The Public Sector Mapping Agreement (PSMA) offers town, parish and community councils the opportunity to access a range of Ordnance Survey products. The PSMA will enable you to share that data between the public, private and voluntary sectors in your area. And local councils can register for a licence.

Geographical data can be used to underpin and therefore enable all town, parish and community councils to provide services, which not only meet local needs, improve quality of life and sustain community well being. They will have access to wider information and perspective which they need to make difficult choices about resource allocation, better data and intelligence at ward and neighbourhood level

English parish councils have been eligible to join the PSMA since April 2011 giving them access to a wide range of Ordnance Survey map data free at the point of use.

For further information, please visit our PSMA website

The Parish Councillor's Guide by Paul Clayden - £15.95

This ever-popular book, regarded as invaluable for all parish councillors and clerks, was updated in 2009 (20th edition) to reflect the large amount of new legislation affecting parish and community councils.